Small modular reactors (SMRs) are the future of nuclear power, and they could become an important strategic export industry in the next two decades

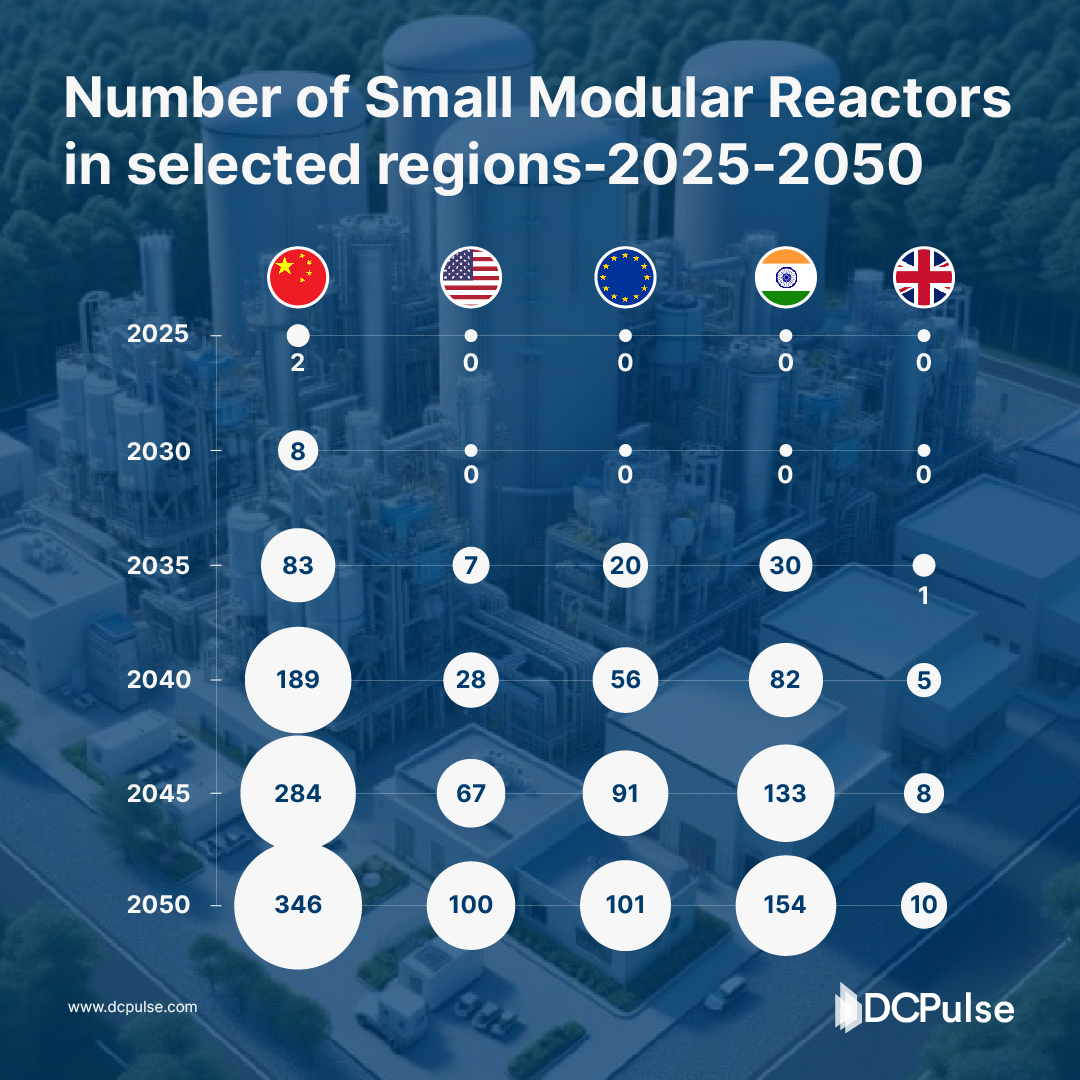

Number of Small Modular Reactors in selected regions in the Announced Pledges Scenario, 2025-2050

|

Year |

China |

United States |

European Union |

India |

United Kingdom |

|

2025 |

2 |

0 |

0 |

0 |

0 |

|

2030 |

8 |

0 |

0 |

0 |

0 |

|

2035 |

83 |

7 |

20 |

30 |

1 |

|

2040 |

189 |

28 |

56 |

82 |

5 |

|

2045 |

284 |

67 |

91 |

133 |

8 |

|

2050 |

346 |

100 |

101 |

154 |

10 |

Source: International Energy Agency

Why Small Modular Reactors Are Game-Changers for Data Centers?

Small Modular Reactors (SMRs) are small nuclear reactors that can be set up quickly and generate power in a small area. SMRs are built in factories, shipped, and put together with less risk and cost than regular nuclear plants.

For data centers, especially hyperscale and colocation sites, this matters because:

- SMRs offer stable, 24/7 baseload power

- They make data centers less dependent on fossil fuels and the unstable grid

- They can be set up on or near campus sites, reducing latency and transmission loss.

In an industry where uptime is non-negotiable, SMRs represent a new era of resilient infrastructure.

How will the global rise of Small Modular Reactors (SMRs) impact the data center power landscape by 2050?

The quick spread of SMRs in major economies is going to change the way data centers get clean, reliable energy. China is expected to run 346 SMRs by 2050, India 154, and the U.S. 100. For instance, in 2024, Constellation Energy CEO Joseph Dominguez cited forecasts estimating U.S. data centre power needs rising from 17?GW in 2022 to 35?GW by 2030, reinforcing the need for new sources like SMRs.

These small nuclear reactors provide a steady supply of power, which is very important for hyperscale data centers and AI workloads. As integrating renewable energy gets harder, SMRs can provide a baseload solution that cuts down on downtime and power fluctuations, two problems that modern data infrastructure has.

Google, Amazon, Microsoft, and Meta are putting money into SMR projects. For example, Amazon gave USD 700 million to X-energy, Google gave money to Kairos, and Microsoft signed a PPA to restart Three Mile Island.

Which countries are leading the charge in adopting SMRs, and what does this mean for hyperscale operators?

China, India, and the United States are the leaders in SMR adoption. Between 2035 and 2050, growth is expected to be very fast. China's jump from only 2 SMRs in 2025 to 346 by 2050 shows it is strategically diversifying its energy sources. This path aligns with what big data centers like Alibaba Cloud and Tencent Cloud are doing to meet their 24/7 uptime needs by investing in sustainable power ecosystems.

Google has signed a contract with Kairos Power to get 500 MW of SMR energy to power its data centers. The first plants are expected to be up and running by 2030.

Microsoft President Brad Smith discussed the potential of "modular nuclear as a critical future enabler for global cloud infrastructure" at a panel in 2025. His comment shows hyperscale cloud providers are more interested in next-generation power solutions.

Are SMRs a good way to fix data centers' long-term power redundancy and sustainability problems?

As power densities rise and the European Union is expected to have 101 SMRs by 2050, it is becoming clear how SMRs and edge-to-core data centers can work together. SMRs are not only carbon-neutral but also very scalable, which means that colocation providers and hyperscale companies can put them closer to campus locations. Nuscale Power and other companies, with help from investors like Fluor Corporation, are already working with energy partners to make SMRs work with data centers. The long-term benefits are less reliance on the grid, a smaller carbon footprint, and more energy independence.

What Tech Leaders Are Saying in 2025

In July 2025, UN Secretary General Antonio Guterres told tech companies that they should use 100% renewable energy to power the building of data centers by 2030. This is happening even though the industry is turning to gas and coal-fired power plants to meet rising demand.

In a January 2025 energy-tech panel, Microsoft’s President Brad Smith made headlines by stating:

“Modular nuclear may become a critical enabler for the global cloud—especially where AI demands power stability at hyperscale."

This fits with Microsoft's long-term goals for sustainability and its work with Terra Praxis on nuclear innovation projects.

President Trump signed four Executive Orders in May 2025 to speed up the deployment of SMRs and make it easier for the NRC to issue licenses. This showed that nuclear power is important for industries that use a lot of AI, like data centers

NuScale Power, a front-runner in commercial SMR deployment, is already collaborating with government and private sector operators to develop SMR-powered data hubs. Their CEO, John Hopkins, stated in Q2 2025:

“SMRs are no longer future-tech—they’re deployment-ready. We’re building the bridge between clean energy and critical infrastructure.”

3 Bold Predictions for SMRs and Data Centers by 2050

-

Hyperscale Data Centers Will Have On-Site SMRs

Hyperscalers like Amazon Web Services, Google Cloud, and Tencent will probably add SMRs to their energy stack because they are focused on latency, redundancy, and sustainability. These could be installations at the site or on a microgrid.

In 2024, AWS is acquiring a hyperscale data center campus directly connected to the Susquehanna Nuclear Station, following a USD 650 Million agreement with Talen Energy, owner of both the campus (Cumulus Data) and the nuclear plant. This marks a pivotal shift toward nuclear-integrated data infrastructure.

Talen Energy CEO Mac McFarland called the deal a “milestone in merging digital infrastructure with reliable baseload power."

-

Energy Zoning Will Favour Nuclear-Ready Regions

Texas, Gujarat, and Inner Mongolia may become more popular data center zones because they have much energy, good SMR deployment policies, and good land infrastructure. Cloud architects will plan for "nuclear-readiness" just like they do for fiber and water access.

-

Carbon Neutrality Goals Will Push Adoption Faster

As data centers must be more strict about Scope 2 and Scope 3 ESG mandates, nuclear energy will become a net-zero accelerator. Colocation companies like Equinix and Digital Realty will likely align with the Paris Agreement, aiming for climate neutrality by 2030.